Social Commerce Trends To Watch In 2026

Passionate content and search marketer aiming to bring great products front and center. When not hunched over my keyboard, you will find me in a city running a race, cycling or simply enjoying my life with a book in hand.

Social shopping is no longer a side experiment. As 2025 closes, platforms are hardwiring commerce into discovery, creators are shaping what people buy, and checkout paths are being rewritten in ways that will define performance in 2026.

For brands planning ahead, these social commerce trends point to where revenue growth is heading next year and which teams will win as social becomes a primary sales channel.

TL;DR

- Social platforms are now the primary entry point for product discovery, with short-form video, UGC, and comments shaping decisions long before checkout.

- Entertainment and live shopping are collapsing the gap between viewing and buying by embedding commerce directly into content.

- Creators have become conversion engines, consistently outperforming brand-only messaging by building trust at scale.

- As platforms retreat from native checkout, brands must own attribution end-to-end, connecting social exposure to site behavior and revenue.

- Privacy regulation and AI-led delivery are weakening targeting precision, making creative quality and testing velocity the new performance levers.

- Retail media and social commerce are converging into a single system, forcing brands to align spend, measurement, and incrementality across channels.

Market Momentum Is Accelerating Social Commerce Into 2026

Social commerce growth in 2025 created clear momentum that will carry into 2026. What was once an experimental channel is now earning sustained budget as platforms, creators, and consumers converge around in-feed buying behaviors.

In the U.S., the social commerce market is expected to reach $114.7B in 2025, growing 14.4% year over year. This scale signals continued justification for social-first commerce investment in 2026, as brands shift budgets toward channels that combine discovery and transaction.

Live shopping is emerging as a major growth accelerator within that momentum. Projections show the category expanding from tens of billions today to nearly $2T globally by 2030. With Western markets driving much of that growth, positioning live formats as a critical commerce lever for brands planning ahead.

With that momentum established, the following sections break down the key social commerce trends shaping how brands will drive growth in 2026.

Social Commerce Trends #1: Discovery-First Commerce

Purchase intent no longer precedes discovery on social – it follows it.

Consumers are not opening social platforms to shop. They are discovering products passively as they scroll, watch, and engage, with buying decisions forming well before any explicit intent appears. By the time a user clicks out, the brand and product have already been evaluated through content, comments, and repetition.

Short-form video, UGC, and comment-driven posts now perform the persuasion work brands once reserved for landing pages. These formats build familiarity, answer objections, and establish social proof upstream of checkout, a shift reinforced by the 2025 DataReportal (GWI) findings showing social as a primary source of brand discovery and education.

This dynamic is amplified by fragmented attention. The average social user now engages with 6.83 platforms per month, meaning discovery does not happen in one place or one format. Brands relying on isolated hero assets or platform-specific messaging struggle to create momentum across feeds.

Winning discovery-first commerce requires cross-platform creative systems that surface consistent commerce signals wherever users encounter them. Brands that fail to show up early and often are not losing at checkout – they are being filtered out long before it.

Social Commerce Trends #2: Shoppertainment + Live Shopping

Entertainment is no longer supporting commerce on social. It is producing it.

As feeds become more crowded and attention more fragmented, users are increasingly resistant to overt sales messaging. Entertainment-led content succeeds because it doesn’t interrupt the experience – it is the experience. Commerce now happens inside moments of humor, education, and community rather than around them.

In 2025, shoppertainment proved it could do what traditional performance ads struggle to achieve: hold attention long enough for intent to form and action to follow. By blending product storytelling directly into content, these formats collapse the distance between viewing and buying without forcing users out of the feed mindset.

TikTok has leaned fully into this model, intentionally blurring the lines between ads, creators, and shopping experiences. Entertainment-led, community-driven content has become the platform’s primary commerce engine, reinforcing the idea that persuasion happens through participation, not interruption.

Live shopping accelerates this effect by adding urgency and interaction. Real-time demonstrations, creator hosts, and audience Q&A recreate the social proof of in-store shopping while maintaining the scale of digital distribution. As platforms invest in better tools and measurement, live formats are becoming easier to execute and increasingly defensible as a revenue channel in Western markets.

Brands that continue to treat entertainment as a top-of-funnel tactic risk driving engagement without conversion. Those that design content to entertain and sell are closing the gap between attention and transaction.

Create and manage video ads with ease

Social Commerce Trends #3: Creator-Led Conversion

Creators are no longer amplifying brand messages – they are driving conversion. As trust in traditional advertising continues to decline, consumers increasingly rely on creator voices to decide whether a product is worth buying.

In 2025, brands leaned more heavily on UGC, affiliate links, and creator-led formats to guide users from inspiration to action. Creators succeed because they answer the questions brands often cannot address directly: Does this actually work? Is it worth the money? Would you buy it? That validation accelerates purchase decisions far more effectively than polished brand claims.

Data from HubSpot’s 2025 survey shows marketers increasingly turning to creators to close trust gaps and influence purchasing behavior. Deloitte Digital reinforces this shift, identifying creators and community voices as central to modern social commerce strategies, with creator-led content consistently outperforming brand-only messaging on engagement and downstream action.

Brands that treat creators as an awareness channel risk leaving conversion on the table. Those that integrate creators directly into performance strategy – across paid, organic, and live formats – are turning credibility into measurable revenue.

Social Commerce Trends #4: Platform Shifts In Checkout And Attribution

Social platforms are stepping back from owning the transaction, forcing a reset in how social commerce performance is measured. As native checkout options disappear, success is no longer defined by in-platform completion but by what happens after the click.

Meta’s removal of native checkout from Facebook and Instagram Shops signals a broader shift toward discovery-led, click-out commerce. Social platforms are increasingly positioned as demand engines rather than end-to-end sales environments, prioritizing content and engagement over transaction ownership.

This shift places more responsibility on brands to connect social exposure to downstream outcomes. Site analytics, server-side tracking, and clear creative-to-conversion mapping are becoming essential as closed-loop attribution fades and performance signals fragment across platforms.

Brands that fail to adapt risk losing visibility into what actually drives revenue. Those that invest in stronger measurement frameworks will be better positioned to scale social commerce without relying on platform-owned checkout or reporting.

Social Commerce Trends #5: Privacy And Regulation Changes Targeting

Targeting on social platforms is becoming structurally less precise, and that shift is irreversible. As privacy regulation tightens and platform policies evolve, brands can no longer rely on granular user data to drive consistent performance.

Regulatory pressure in 2025 accelerated this transition. Enforcement actions under frameworks like the EU’s Digital Markets Act reinforced limits on how platforms can collect, combine, and activate user data, signaling a broader global move toward privacy-first advertising environments.

Platform changes are compounding the impact. Meta’s plan to allow EU users to opt for less personalized ads beginning in 2026 will further reduce targeting fidelity across Facebook and Instagram, weakening many data-dependent optimization strategies brands have relied on for years.

As targeting precision erodes, creative quality becomes the primary performance lever. Brands that invest in rapid testing, strong creative systems, and contextual relevance will be better positioned to sustain results as data signals fade. Those that wait for targeting to “recover” will be optimizing for a past that isn’t coming back.

Andromeda Update

Meta’s Andromeda update reinforces this shift. By relying more heavily on AI-driven delivery and creative-level signals, Meta is deprioritizing manual targeting in favor of content performance. As a result, what an ad shows increasingly matters more than who it is shown to – accelerating the move toward creative-led optimization.

Create and manage video ads with ease

Social Commerce Trends #6: Retail Media And Social Commerce Are Converging

Retail media and social commerce are no longer operating as separate performance channels. As brands push for scalable, measurable growth, these systems are increasingly planned, funded, and evaluated together.

Retail media spend continued to accelerate in 2025, with offsite placements expanding beyond owned retail environments and into social platforms. This overlap turns social feeds into commerce-driven media environments, where discovery, influence, and conversion signals increasingly mirror those used in retail ecosystems.

As a result, brands are aligning social commerce efforts with retail media measurement frameworks. Incrementality, reach, and downstream sales impact are becoming shared metrics, replacing siloed KPIs that once separated awareness from performance.

Brands that continue to manage social and retail media in isolation risk misallocating spend and underestimating impact. Teams that treat them as a connected system will gain a clearer view of how social discovery drives retail outcomes – and where growth can scale most efficiently.

Social Commerce Trends Summary

Social commerce in 2026 will reward brands that treat social as a discovery-led, creator-powered system rather than a checkout feature. The shifts of 2025 made it clear that influence, education, and entertainment now shape buying decisions long before any explicit purchase intent exists.

As targeting precision weakens and AI-led delivery systems prioritize creative performance, content quality has become the primary driver of results. Brands that invest in scalable creative systems, UGC, and platform-native formats will be better positioned to adapt as audience controls fade and algorithms reward relevance over precision.

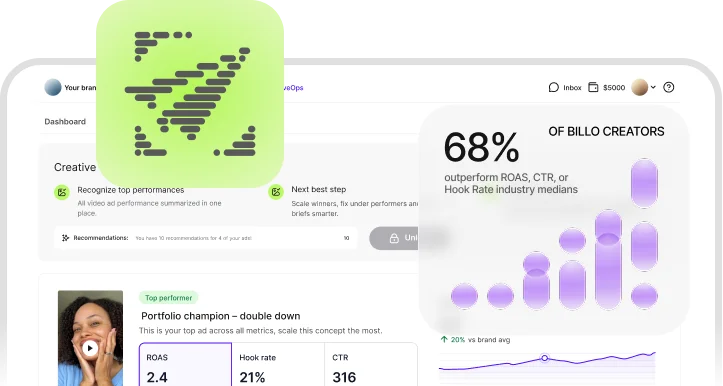

Creators sit at the center of this evolution. For teams looking to operationalize these trends, scaling creator content is no longer optional. Platforms like Billo help brands produce high-performing UGC at volume, enabling faster testing, stronger creative signals, and a clearer path from social discovery to measurable revenue.

FAQs

Which Social Commerce Trend Matters Most For Early-Stage Brands In 2025?

Discovery-first commerce matters most for early-stage brands because it allows them to build awareness and trust before driving conversion. Short-form video, UGC, and creator-led content help smaller brands compete without relying on heavy ad spend or advanced targeting.

How Should Teams Measure ROI When Platforms Remove Native Checkout?

As native checkout is removed, teams should focus on site analytics, server-side tracking, and clear creative-to-conversion mapping. Connecting social touchpoints to downstream revenue provides a more accurate view of performance than in-platform metrics alone.

What’s The Impact Of EU Privacy Regulation On Global Social Commerce Strategy?

EU privacy regulation is reducing targeting precision and accelerating the shift toward privacy-first commerce strategies. Even for global brands, these changes increase the importance of creative quality, contextual signals, and scalable testing frameworks.

How Can Brands Test Live Shopping Without Large Production Budgets?

Brands can start with creator-led live formats that prioritize authenticity over production value. Using existing creators, simple setups, and platform-native tools allows teams to validate engagement and conversion before scaling investment.

SEO Lead

Passionate content and search marketer aiming to bring great products front and center. When not hunched over my keyboard, you will find me in a city running a race, cycling or simply enjoying my life with a book in hand.

Authentic creator videos, powered by real performance data

22,000+ brands use Billo to turn UGC into high-ROAS video ads.

Social Commerce: Turn A 15-Second Scroll Into A...

Social shopping used to mean “link in bio.” Now social commerce keeps [...]...

Read full articleAd Hooks That Scale: Turning 1 Winning Angle Int...

Performance teams often think they need endless novelty, but newer [...]...

Read full article3 Ways Shopify Brands Use Billo + Moast Together...

User-generated content (UGC) is no longer just a nice-to-have, it’s [...]...

Read full article